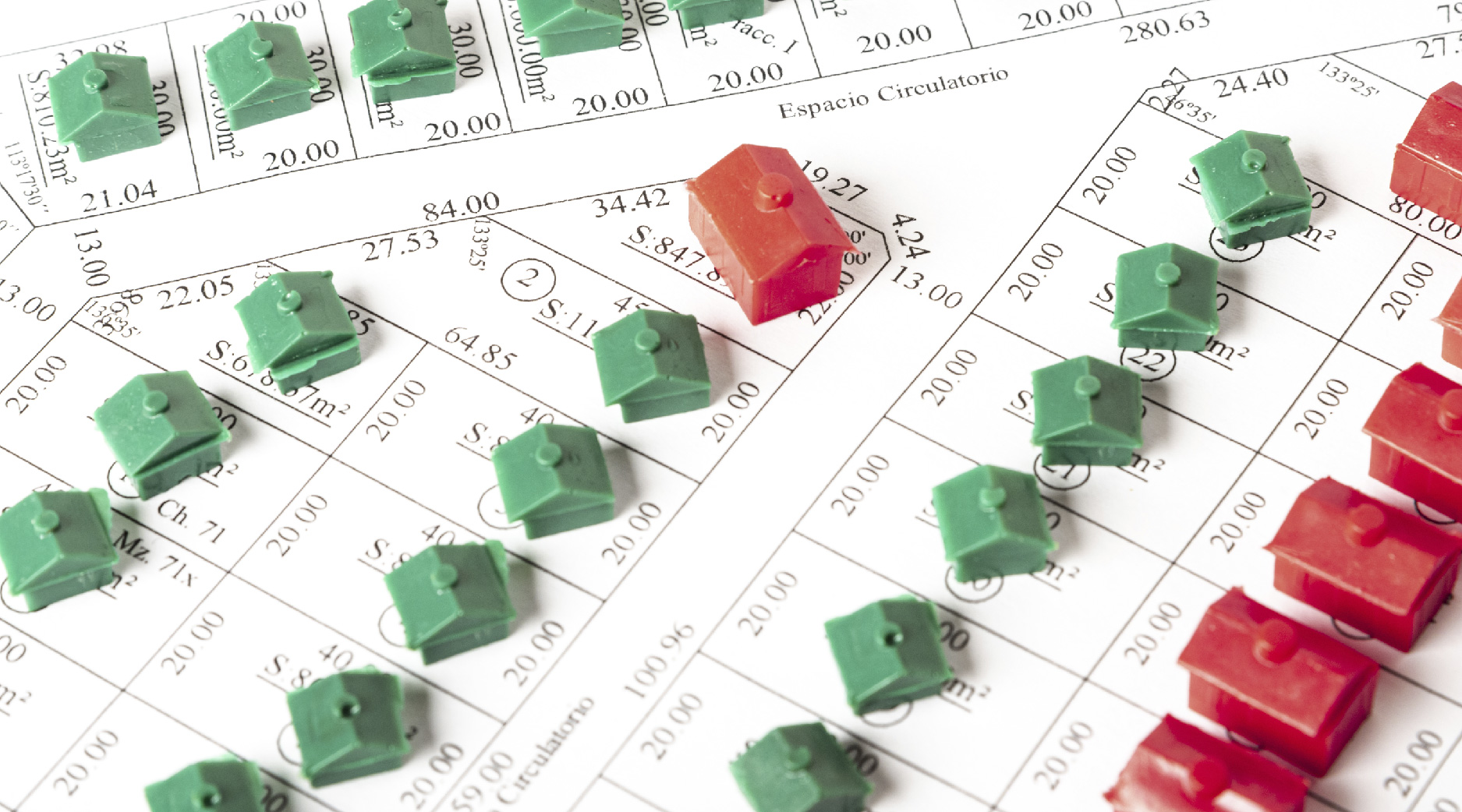

Real Estate

REAL ESTATE TOKENIZATION

Real estate tokenization is recognized as an emerging investment space represented by the merging of real estate investment and blockchain technology. Tokenization helps asset or fund holders raise capital more efficiently and provides investors with transparent and secure access to private real estate investments. Tokenization helps asset or fund holders raise capital more efficiently and provides investors with transparent and secure access to private real estate investments. Here will explained what tokenization means, how owners and investors can benefit, and how the tokenization process works.

HOW TO TOKENIZE A REAL ESTATE ASSET?

Tokenization is a term used to describe a technology in which investors exchange fiat currencies for "digital certificates". In short, tokenization is a way to securitize real assets. Securitizing an asset by tokenizing it also means dividing it into shares that you can sell to investors. Likewise, to "tokenize" an asset is to divide it into shares or "tokens" that represent a predefined share of the underlying asset.

HOW TO CREATE A REAL ESTATE TOKEN?

When an asset owner decides to tokenize a property, a 'digital real estate share certificate (DGPS)' is created in Ethereum etc standards (ERC20 etc.) to represent shares of the property. The total value of all 'digital real estate ownership certificates (DGPS)' will equal the total value of the securitized asset. Thus, each customer will be able to purchase a share of the property according to their budget.

HOW DO INVESTORS AND OWNERS BENEFIT FROM TOKENIZATION?

Tokenization eliminates the middleman, making it easier and cheaper for investors to buy/sell real estate and for owners/developers to raise capital. Investors can trade tokens, namely 'digital real estate certificate of ownership (DGPS),' almost instantly and for a very low fee. For property owners, tokenization also makes it possible to raise capital without financial intermediaries to finance the project. Real estate has provided attractive returns for generations, but it is a barrier to investment for low-budget households as the assets are often geared towards higher budgets. Those who invest in tokenized real estate assets have the most advantageous investment opportunity with the high return on their real estate investments.

THE FUTURE OF REAL ESTATE TOKENIZATION

The global real estate market is valued at approximately US$228 trillion. Prior to the tokenization of real estate, only accredited and institutional investors had access to the most exciting projects. However now asset owners and developers can market their projects globally to small-budget retail investors and institutions. Tokenization will also bring much-needed transparency to the real estate industry, which has traditionally been used to acting. The ability to buy and sell shares in real assets in real time will attract greater investor interest and unlock more potential for more ambitious and unique real estate developments. The tokenization of real estate gives investors and owners the freedom to raise/invest as they wish. Tokenization will also positively impact other asset classes such as private equity and venture capital.